On Monday, July 21, 2025, EQT Corporation’s share price experienced a sharp decline of over 9%. Such significant intraday drops often make investors wonder: what typically happens in the subsequent months? Do stocks usually rebound, plateau, or continue to decline? To gain insight, let’s analyze historical instances where EQT stock witnessed similar substantial drops and observe how it performed over the next three months.

Historical Instances of Large Price Drops & Their 3-Month Outcomes

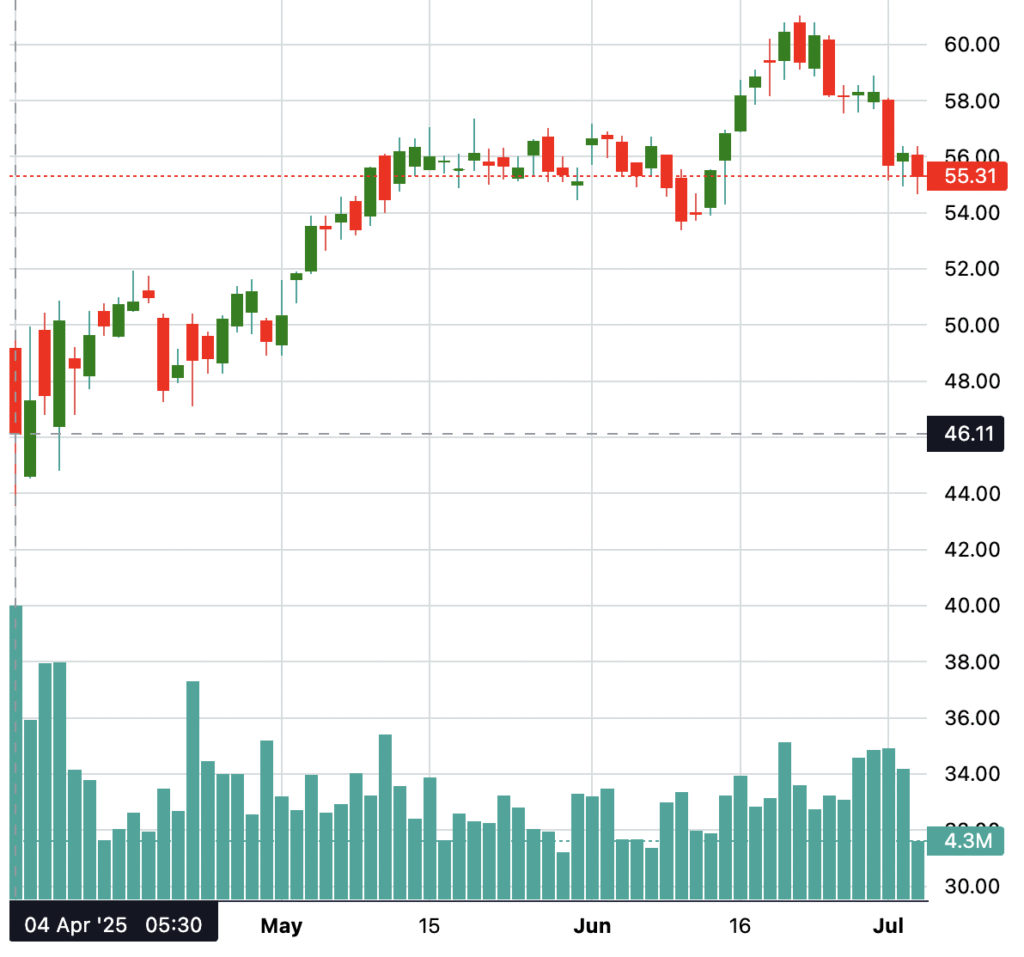

4th April 2025 (-11.48%)

On April 4th, 2025, EQT stock plummeted by 11.48%. Curiously, over the following three months, the stock demonstrated a strong recovery, climbing significantly from its low. This scenario suggests that sharp declines can sometimes be followed by a rebound, possibly driven by market correction, investor relief, or sector-specific catalysts.

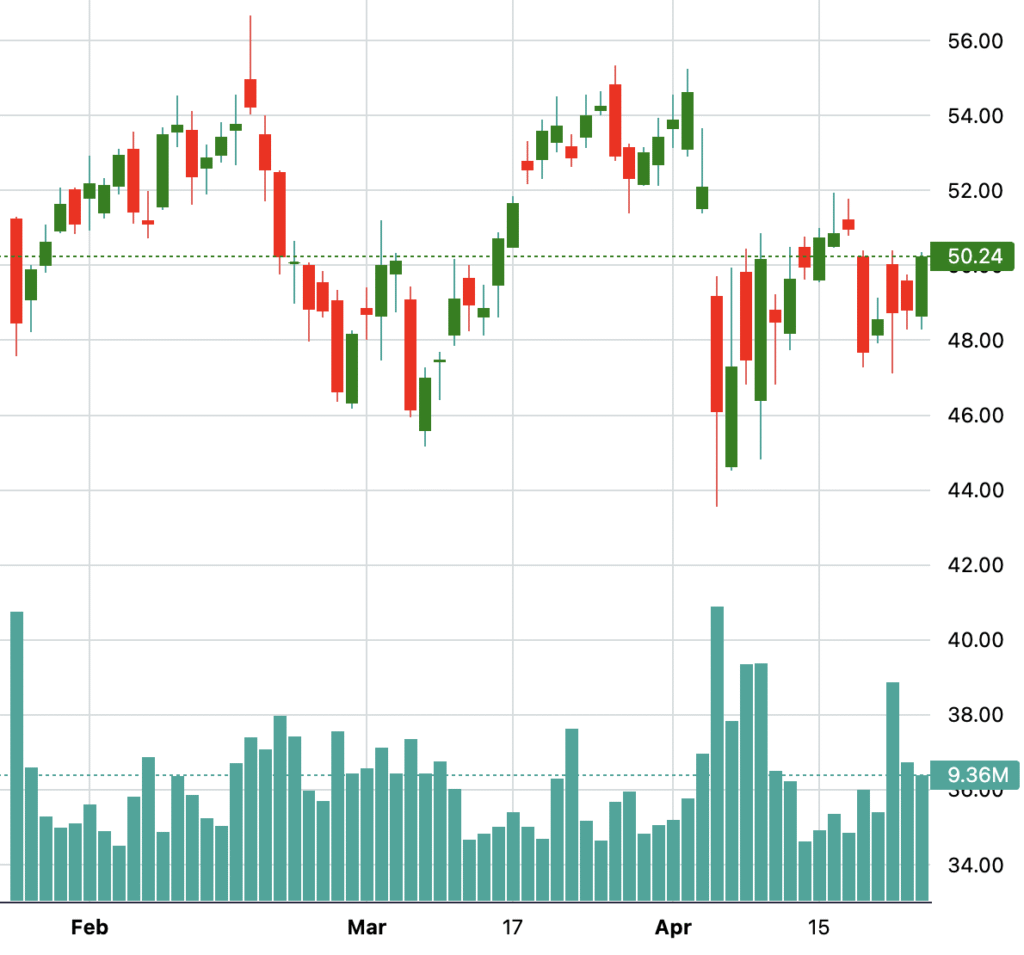

27th Jan 2025 (-9.72%)

Just prior, on January 27th, 2025, EQT faced a nearly 10% loss. However, unlike the previous case, the stock displayed a volatile but sideways movement, ending the three-month period close to its starting point. This indicates that not all large drops lead to positive rebounds; instead, many stocks turn into choppy trading ranges, reflecting uncertainty or lack of clear catalysts.

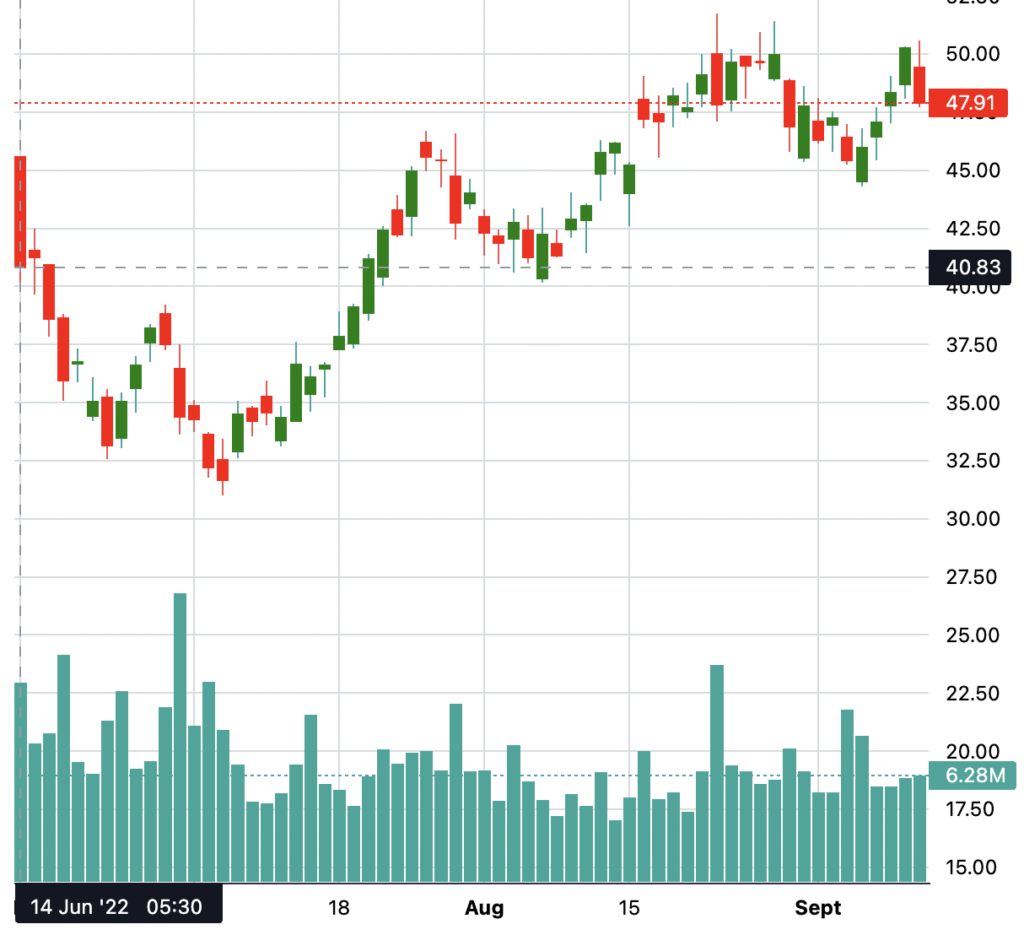

14th June 2022 (-9.41%)

After dropping approximately 9.4%, EQT’s price in June 2022 experienced a moderate rally over the following months, although it also suffered sharp declines at times. This mixed performance underscores that large drops don’t guarantee directionality—volatility may persist before a clearer trend emerges.

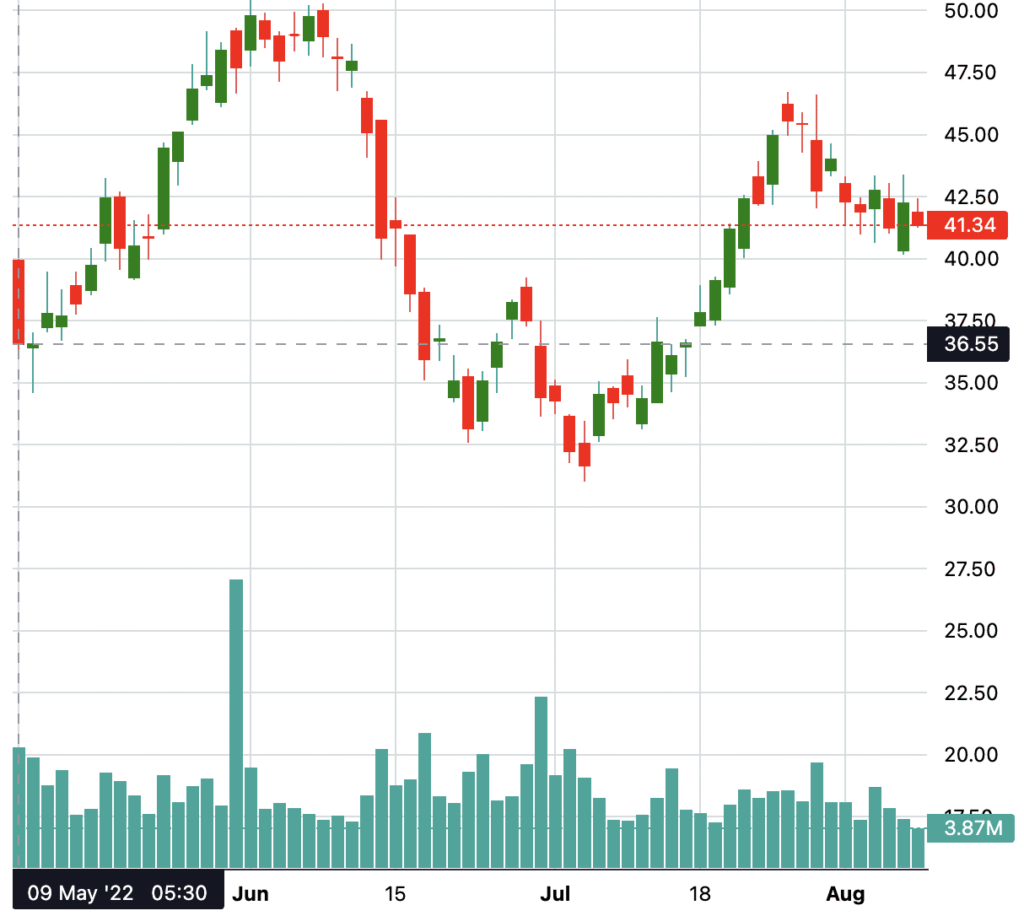

9th May 2022 (-10.96%)

In May 2022, EQT’s stock declined nearly 11%, yet within three months, it showcased high volatility without a clear trend, swinging sharply up and down. Such behavior suggests that large intraday declines may sometimes lead to indecisiveness in the market, especially absent fundamental or sector-specific catalysts.

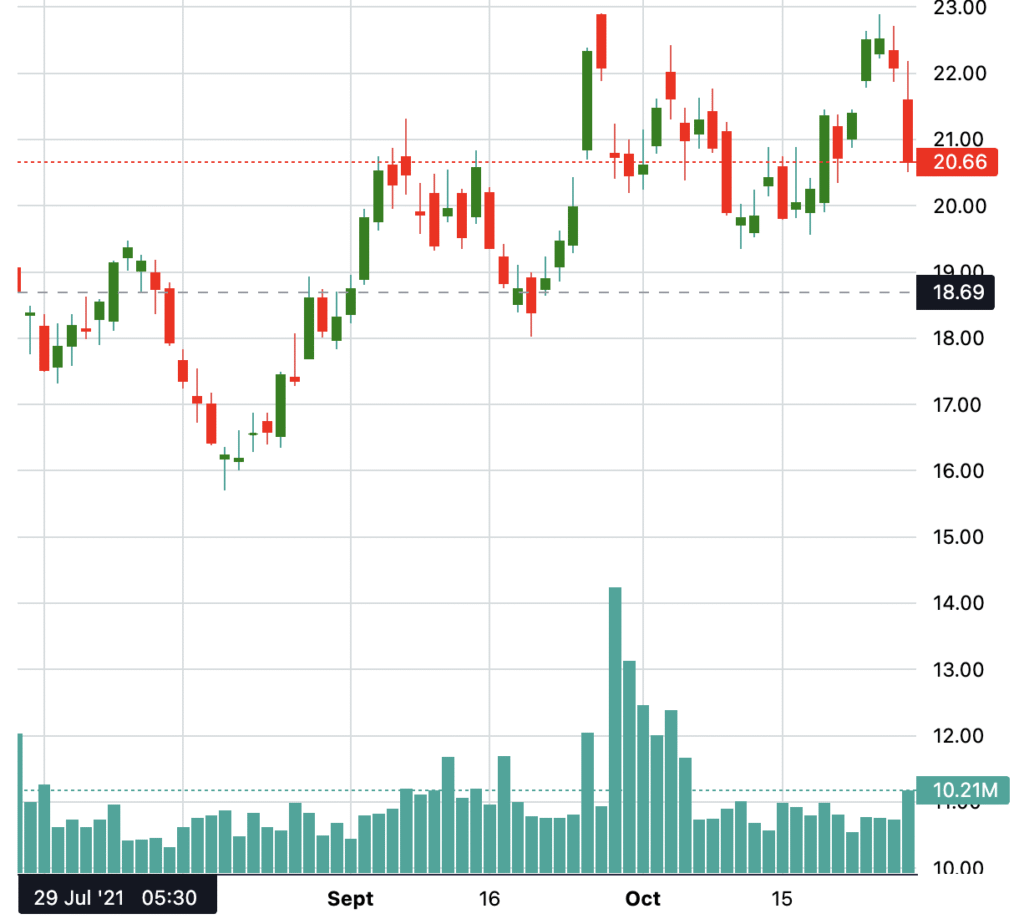

29th July 2021 (-9.93%)

In mid-2021, EQT experienced a roughly 10% drop, but over the subsequent three months, the stock ultimately moved higher, bucking the trend of continued decline. This rebound could have been driven by sector recovery, improved fundamentals, or broader market tailwinds.

What Can We Learn From These Examples?

Examining these past instances reveals that there is no consistent pattern following a large intraday drop. The stock can:

- Experience a strong rebound (as seen in April 2025 and July 2021).

- Enter a prolonged sideways or choppy phase (January 2025, May 2022).

- Show high volatility with no clear trend (June 2022, May 2022).

In other words, EQT’s subsequent three-month performance after a significant drop varies widely. External factors—sector conditions, macroeconomic trends, company-specific news—often influence these outcomes.

Investment Takeaways

- A large stock decline does not guarantee continued fallout; it can be a buying opportunity or just a temporary market reaction.

- Investors should consider broader market conditions, earnings reports, and sector trends before making decisions based solely on short-term dips.

- Diversification and proper risk management remain essential.

Disclaimer

The analysis above is purely educational and is based on historical data. Stock markets are unpredictable, and past performance does not guarantee future results. Always perform your own due diligence or consult a licensed financial advisor before investing.

Data Source: All charts and data are sourced from Twelve Data, a third-party provider. While efforts are made to ensure accuracy, we do not guarantee the data’s authenticity or completeness.

Final Thoughts

While big drops can be intimidating, historical data shows they often don’t result in uniform outcomes. Whether EQT stock bounces back or remains volatile depends on many factors beyond just the percentage decline. As always, stay informed, diversify your portfolio, and invest wisely.